You will cover 20% of the covered expense ($20) and your insurance company will cover 80% ($80). You visit the dermatologist (a specialist) and have a $100 bill. When you visit a specialist, you have a 20% co-insurance.

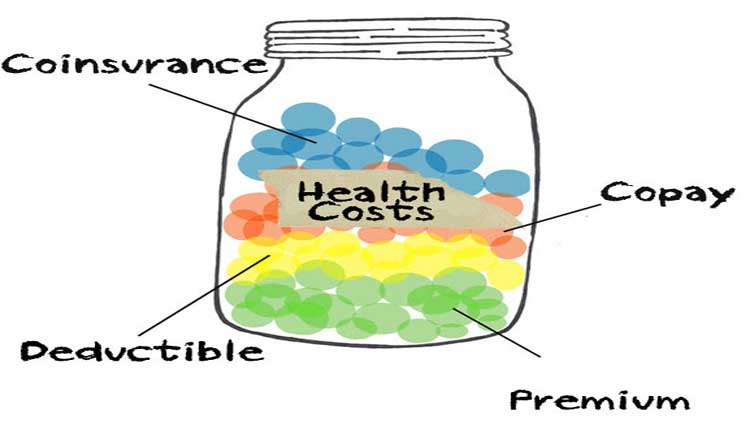

For example, let’s say you’ve met your deductible of $2,500 for the year. After you meet your deductible, you’ll likely have what’s called “co-insurance.” Co-insurance is basically a fancy term for the cost sharing percentage between you and the insurance company.The out-of-pocket maximum is the most you’ll pay out of pocket for the policy year. Your deductible is the amount you’ll pay before the health insurance company begins helping you pay for your covered expenses. How much you pay out of pocket depends primarily on two things: your deductible and your out-of-pocket maximum.As you begin shopping for your new plan, it’s likely that you’ll come across the terms “High Deductible Health Plan” and “Co-Pay Plan.” You may be wondering what the differences are between these plans and which is right for your healthcare needs and budget? Here are some key differences to keep in mind as you make your 2018 coverage decisions: 2018 Open Enrollment is here, which means it’s time to evaluate your health insurance options for the coming year.

In the meantime, here's to a healthier you.ĭisclosure: NBCUniversal and Comcast Ventures are investors in Acorns. Of course, there are other costs and terms to keep in mind when talking health insurance, like copays and coinsurance, out-of-pocket limits, and knowing how your plan differs for providers in-network or out-of-network. That brings your total medical bill up to $1,800, even though the whole surgery costs $5,000. So of the $4,000 you still owe, your insurer will cover $3,200. Most plans pay a percentage of the remaining balance, typically around 80%. As long as the procedure is in network, then your insurance starts to kick in. You hurt your knee, go to the doctor, and find out you need to repair a torn meniscus. Let's say you pay a $100 premium every month and you have a $1,000 annual deductible. The financial lessons this mother of two learned after suffering an unimaginable loss.Josh Brown: How I explain the stock market vs the economy.What your FICO score means and why you should pay attention.This is probably better for healthy people who are willing to take a little more risk with their costs. You might want to pick a plan like this if you know you will have significant medical costs next year.Īnd the reverse is usually true too: Lower monthly premiums usually mean a higher deductible.

These terms are related in one simple way - plans with higher monthly premiums (meaning you're paying more every month), often have a lower deductible (meaning your insurance company will start paying sooner). Deductibles may range from a couple hundred dollars to several thousand. That's the amount of money that you need to spend out of pocket on health care each year before your insurance starts covering your bills. It's a number that signifies an annual threshold, and it's distinct for every plan. For many people who work for companies that offer health insurance, the premium comes out of your paycheck automatically. Personal Loans for 670 Credit Score or Lower Personal Loans for 580 Credit Score or Lower Best Debt Consolidation Loans for Bad Credit

0 kommentar(er)

0 kommentar(er)